Suggested Search

At Colonial First State, we define responsible investment as a strategy and practice that incorporates a range of ESG and climate-related factors in the investment decision-making process.

We also believe that as stewards of your investments, investing responsibly is about the careful execution of our investment duties on your behalf. Our beliefs are driven by our guiding principles of integrity, balance, transparency, and focus – and these shape our six strategic pillars.

Our beliefs

- Good investment management of ESG and climate risks can improve the potential long-term performance of companies and, as a result, also improve returns for members.

- Climate is a financial risk that will have economic and social impact and needs to be managed.

- Active ownership (for example, working with investment managers to vote on our behalf at shareholder meetings for the companies we’re invested in) can lead to better long-term return

Our guiding principles

Integrity

The interests of members and our fiduciary duties are at the heart of everything we do.

Balance

We listen carefully to all sides of the conversation to continually deepen our understanding.

Transparency

We clearly explain the basis of our decisions and our progress on our Responsible Investment Policy.

Focus

We strive to offer meaningful responsible investment strategies to help support investment choices.

Our commitments

We are committed to understanding your ESG and climate change concerns and reflect the growing public awareness of these issues through the development of innovative products and services.

Our team places ESG considerations at the heart of our decision-making and active ownership practices and looks to engage with companies and investment managers to encourage the disclosure of ESG and climate risks. Ultimately we seek to ensure sustainable, long-term wealth creation, protection and enhancement by understanding and assessing these risks and opportunities.

Together, our team can help you create meaningful change – not only for your financial future, but to achieve positive social and environmental impact as well.

Our approach

Embedding environmental, social and governance (ESG) considerations into the investment process is no longer just a trend – it is simply what we do.

Colonial First State’s approach to asset stewardship and delivering sustainable investment outcomes is driven by our beliefs and outlined in our Responsible Investment Policy.

In order to incorporate ESG and climate risk considerations into our existing investment decision-making and active ownership practices, we follow some general principles.

Our approach centres around six strategic pillars:

ESG and climate change factors are integrated into the investment decision-making process through an analysis of the investments in our portfolios. This is done prior to appointing any investment manager and on an ongoing basis. Colonial First State’s approach is to:

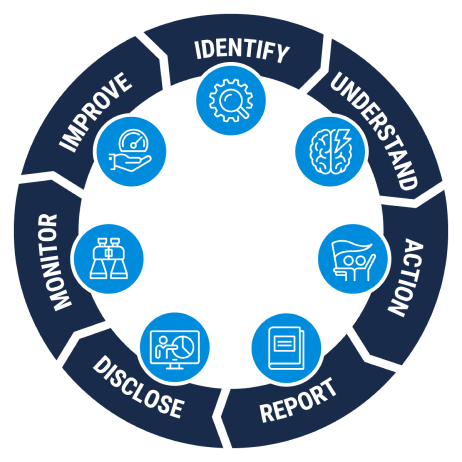

Refer to graphic below

Identify

We identify the ESG and climate risks and opportunities of each portfolio.

Understand

We seek to understand the drivers of these risks and opportunities, and what our investment managers are doing to manage them.

Action

We take appropriate actions (that is, how we choose to engage with investment managers and, where appropriate, seek change).

Report

We report internally on the ESG and climate risks within each portfolio.

Disclosure

We have committed to being transparent regarding how we manage ESG considerations and to also annually disclose our progress against our commitments, aligning our reporting with established standards.

Monitor

We carefully track the ESG and climate risks and opportunities for each portfolio on an ongoing basis.

Improve

We will manage, reduce and/or mitigate the ESG and climate risks of each portfolio over time.

Our team has a responsibility to allocate our customers' capital to productive purposes in the pursuit of sustainable, long-term investing. As a result, we believe it is part of our stewardship role to exercise our rights as shareholder. This includes voting on how a company operates its business and engaging with our managers to encourage change.

In general, we will not take a position on, or make judgement of, an ethical or socially responsible issue unless it is specific to our investment strategy. However, there may be some ESG risks, ethical issues and circumstances in which we believe it is appropriate to take action, whether that’s through the use of negative screens, exclusions or active engagement with our investment managers.

At Colonial First State, we believe modern slavery has no place in society and we all share the responsibility to eradicate it as a matter of priority. Aside from the huge impacts on society and, of course, the individuals involved, modern slavery has negative repercussions for companies and future development. Any company that profits from using forced labour is doing so illegally. Unfortunately, that doesn't mean it isn't happening. In fact, according to the International Labour Organisation (ILO), total profits obtained from the use of forced labour in the private economy worldwide is estimated to be around US$150 billion per year.

Our team recognises that poor company management of climate change risks could result in financial losses, litigation liabilities, and the devaluation of tangible and intangible assets – all of which could impact shareholder value and increase the volatility of investor returns.

Our journey to become a more responsible investor began in in 2015 with work that led to our Responsible Investment Framework. This has evolved and continues today with the renewal of our commitment in our Responsible Investment Policy. By continuing the disclosure of our journey through communication and education, we aim to provide customers with the means for sustainable, long-term wealth protection and enhancement

Useful Tools

Funds and Performance tool

Plan, compare and monitor your investments with our new tool.

Risk Profiler

Knowing your risk tolerance can help you make more informed investment decisions. Find out your risk profile.

Find a Local Adviser

We recommend speaking to an adviser to help you identify and achieve your financial goals.

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL). It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the Financial Services Guide (FSG) available online for information about our services. This information is based on current requirements and laws as at the date of publication.