Suggested Search

Some of our most popular MySuper products delivered double-digit returns

Performance is for the 12 months to 29 February 2024. Past performance is no indication of future performance.

FirstChoice Employer Super’s Lifestage 1965-69 delivered a

13.04% p.a.

for the 12 months to 29 February 2024

FirstChoice Employer Super’s Lifestage 1975-79 delivered a

15.24% p.a. return

for the 12 months to 29 February 2024

Wholesale Personal Super average admin fee

0.2% p.a.

on a super balance of $50,000, compared to the super fund average of 0.46%^

Everyone deserves better than average.

Your super shouldn't be average either.

Our passion for performance and service

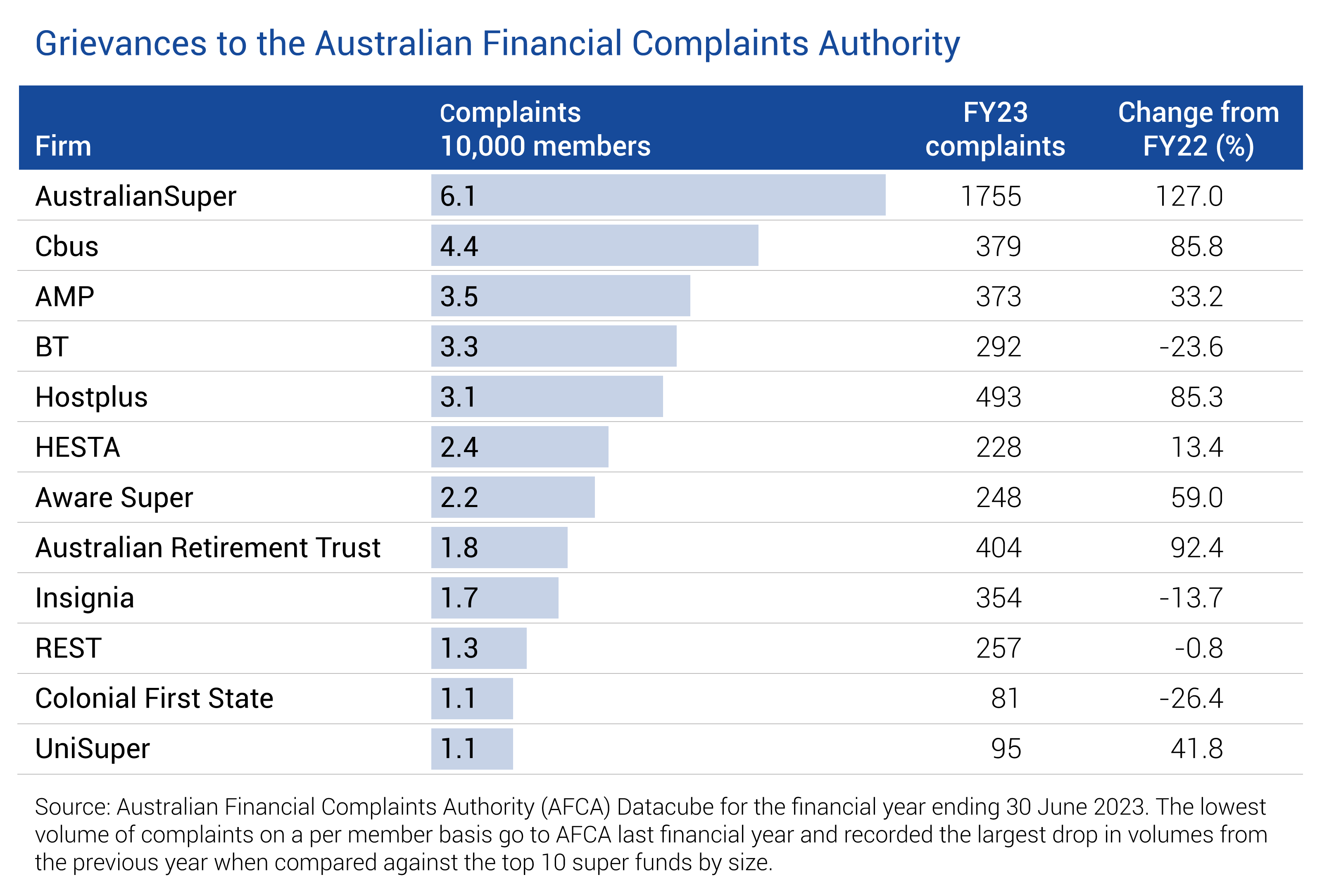

While we’re laser focused on providing strong long-term performance for our members, it’s equally important to us that every member has positive interactions with the CFS team and can rely on us whenever they need our help. We work hard to try and resolve complaints when raised directly with us, and this has resulted in less of our members having to escalate their complaint to the Australian Financial Complaints Authority (AFCA).

CFS has some of the lowest level of member complaints raised at AFCA compared to our competitors, which demonstrates our commitment to creating positive experiences and meeting our members’ needs.

Take a long-term view

Super is a long-term investment. Depending on when you intend to retire, you might have your money invested for 20 years or more. That’s a lot of investment market cycles.

When you’re comparing products and investment options, we always recommend taking a long-term view because you can’t get the full picture on short-term results alone. Take a look at how the option performed over one, three and five years – and even longer if possible. That will give you a more rounded view of the ability of the option and its investment manager to perform in various market conditions. But keep in mind that investment returns aren’t guaranteed and past performance is no indication of future performance.

Use our performance tool to check the long-term performance of every investment option for our super, pension and investment products.

Strong performance. Expert service. Consistently awarded.

Money magazine

Best of the Best

2024

Highest Super Performer - FirstChoice Employer - CFS Geared Share Select

Money magazine

Best of the Best

2024

Best Fixed Interest Pension Product

- FirstChoice Wholesale Pension - First Sentier Global Credit Income

Money magazine

Best of the Best

2024

Highest Pension Performer - FirstChoice Wholesale Pension - CFS Geared Share

Unleash in ways you never thought possible

Get in touch

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Find a financial adviser

Use our tool to find professional financial advice,

local to you.

Download mobile app

Track your balance and see your

transactions history from anywhere.

^Administration fees and costs are compared based on FirstChoice Wholesale Personal Super options (excluding FirstRate options) for a member balance of $50,000, effective 22 May 2023. It does not take into consideration investment fees and costs or transaction costs. Please see the PDS for these fees and costs. The super fund average is based on the Chant West Super Fund Fee Survey at 30 June 2023 that compares average fees by segments and across four investment risk categories. The segments are made up of Industry Funds, Public Sector Funds, Corporate Stand-Alone Funds, Corporate Master Trusts, Retail Master Trusts & Core Wraps and Wrap Accounts. Investment risk categories are made up of Conservative, Balanced, Growth and High Growth. Data sourced from the Chant West Super Fund Fee Survey, effective 30 June 2023, is based on information provided to Chant West by third parties that is believed accurate at the time of publication. Fees may change in the future which may affect the outcome of the comparison. Chant West may make adjustments to fees and costs for comparison purposes and therefore data may vary to other published materials.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36. Past performance is no indication of future performance.